Author: Pranav Jaswani, Technology Analyst at IDTechEx

Small vehicles, such as two-wheelers, three-wheelers, and microcars, are among the most electrified of all vehicle segments globally. These ‘micro EVs’ were initially developed using lead-acid (Pb-acid) batteries – but IDTechEx’s “Micro EVs 2025-2045: Electric Two-Wheelers, Three-Wheelers, and Microcars” report finds that a swift transition towards Li-ion batteries is currently underway. IDTechEx forecasts that Li-ion will grow to dominate the micro EV market, which is set to be worth nearly US$90 billion by 2045.

Why have micro EVs used Pb-acid batteries?

The initial developments of the micro EV market were centered around Pb-acid battery technology. Chinese manufacturers were the first to produce micro EVs en masse in the 1990s, with the country seeing a boom in electric moped sales. This came at a time when Li-ion technology was only beginning to gain prominence and was far from the status it holds in the mobility industry today. Manufacturers, therefore, resorted to Pb-acid batteries, a mature and widely available option that offered sufficient power and range for their intended application.

Fast forward to 2025, and Pb-acid batteries have remained a mainstay technology for micro EVs. This is especially true for mopeds and for three-wheelers, and comes in spite of the rapid development of Li-ion batteries in the intervening decades. IDTechEx’s “Micro EVs 2025-2045: Electric Two-Wheelers, Three-Wheelers, and Microcars” report finds that there remains high demand for low-power, short-range vehicles in these segments, particularly in Asia, and Pb-acid batteries continue to meet their needs well.

Many manufacturers have built up plenty of experience with Pb-acid batteries and are hesitant to switch to an alternative technology, especially one that is less accessible to smaller producers. Costs are also incredibly important in price-sensitive markets such as micro EVs and in lower-income economies (for example, in Southeast Asia, which has high two-wheeler use). Pb-acid wins out here as well, with average prices 2-3x less than a Li-ion product of the same size.

Why are micro EVs transitioning to Li-ion?

In spite of the benefits that Pb-acid batteries can provide, the micro EV landscape has gradually shifted into the domain of Li-ion batteries. Recent years have seen this shift happen even faster, with the motorcycle and microcar classes now primarily Li-ion driven.

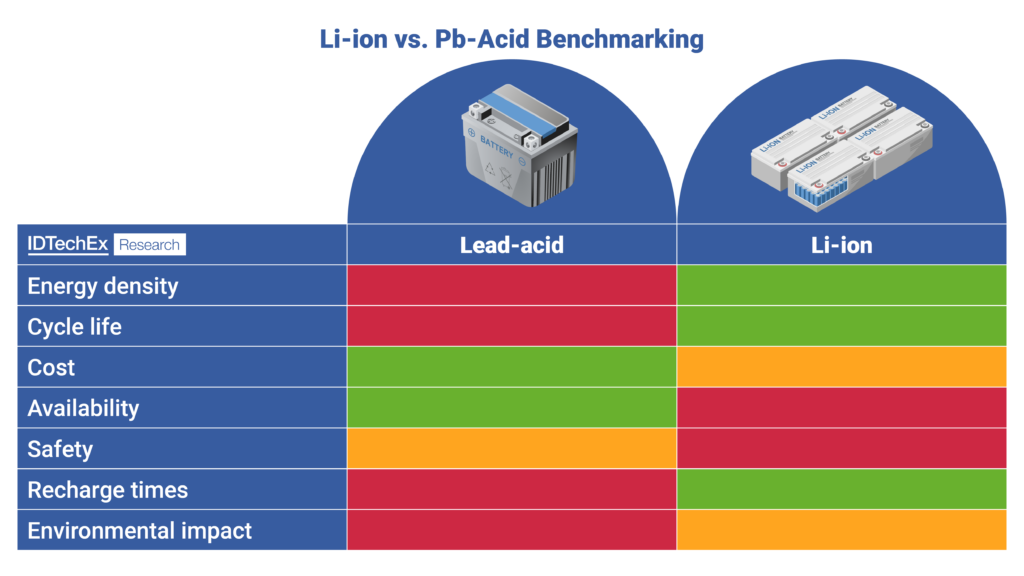

Benchmarking of Pb-acid & Li-ion battery technologies. Source: IDTechEx

One major factor in the acceleration of Li-ion adoption is its clear performance advantages over Pb-acid. Li-ion has far superior energy density, cycle life, and recharge times. All of these make it the go-to choice for higher-power or longer-range applications that require greater energy intensity (i.e., motorcycles and microcars, respectively). This also makes them the default choice for most commercial micro EVs, where heavy loads may need to be transported and where fast charging can be integrated into a daily operating cycle.

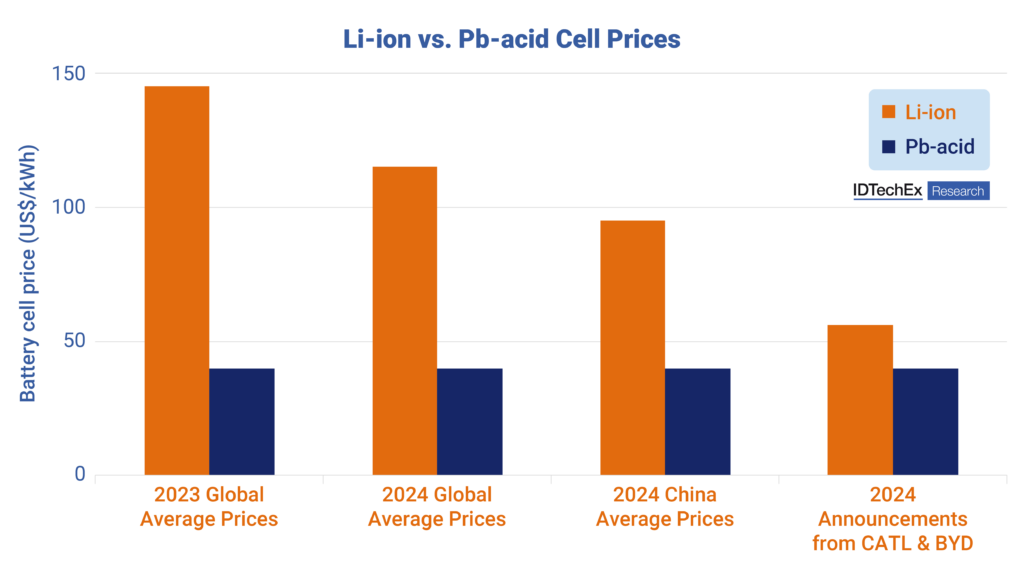

It is true that Li-ion batteries are still more expensive. However, the IDTechEx report reveals that prices are falling quickly, and Li-ion is now far more cost-competitive than it once was. Global average prices for Li-ion cells fell from US$145/kWh in 2023 to just US$115/kWh in 2024. In China, which is the largest micro EV market globally, prices can be even lower, at around US$95/kWh.

The future holds even greater price reductions for Li-ion batteries. Major manufacturers, including CATL and BYD, have already announced prices as low as US$56/kWh. Meanwhile, there is little room for price reductions in Pb-acid given their maturity, and prices have stagnated at around US$40/kWh. The speed with which Li-ion prices are falling will be a key driver of their uptake in the micro EV industry.

The battery sizes of micro EVs are fairly small, which means that even at current battery prices, the difference in cost between a Li-ion battery and a Pb-acid battery for an electric moped is roughly US$200. However, “Micro EVs 2025-2045: Electric Two-Wheelers, Three-Wheelers, and Microcars” finds that the cycle life of the Pb-acid battery is far inferior, and it will need to be replaced multiple times within the lifespan of the moped. This counteracts the price differences between the two batteries, achieving a net even or even a slight advantage for Li-ion in terms of total cost of ownership competitiveness.

Li-ion vs. Pb-acid cell prices through recent developments and announcements. Source: IDTechEx

Finally, governments are also working hard to phase Pb-acid out of their local micro EV markets. The improper disposal of Pb-acid batteries can lead to lead and acid waste leaching into the ground and into bodies of water. The impacts of this can be devastating to the environment, including the depletion of aquatic life, landfill fires, and air pollution. Using Li-ion batteries instead (while having their own disposal and environmental challenges) is seen by governments as a way to mitigate the risks posed by Pb-acid.

Regulations limiting Pb-acid use are strongest in Asia, where the batteries are most popular today. India’s FAME II subsidy scheme, which has reshaped the country’s domestic micro EV market, only provides subsidies for Li-ion equipped vehicles. Meanwhile, its government is also backing local production of Li-ion cells through additional funding. China and Indonesia also regulate Pb-acid usage through a series of laws and a push for greater standardization of Li-ion battery packs.

“Micro EVs 2025-2045: Electric Two-Wheelers, Three-Wheelers, and Microcars” highlights the technological transition the micro EV industry is currently going through and examines its key drivers in greater detail. It also provides up-to-date sales trends, key player and product benchmarking, and critical market developments. Granular 20-year forecasts broken down by region, vehicle type, power, and battery chemistry lay out how the global market will grow to US$90 billion by 2045.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/microEVs.

For the full portfolio of electric vehicle market research available from IDTechEx, please see www.IDTechEx.com/Research/EV.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.