IDTechEx Analyzes US Tariffs’ Impact on the EV Charging Market

The recent US tariffs implemented in 2025 will significantly impact the EV charging market, affecting both the physical charging equipment and the broader electrical infrastructure required to support it.

Potential impact on charging hardware

Many EV chargers rely on high-quality copper wiring for power transmission. Tariffs that increase the cost of copper are likely to drive up the cost of cable manufacturing. Elevated costs might prompt manufacturers to source raw materials domestically or from alternative suppliers, potentially affecting lead times and overall project costs. The rate and effective date for tariffs on copper are yet to be determined by the Department of Commerce’s investigation.

Switchgear components often include conductive materials such as copper and aluminum, along with structural and protective materials like aluminum, steel and plastics. Tariffs on steel and aluminum could increase production costs for these parts, thereby increasing the overall price of the charger’s assembly. The active 25% tariff on all steel and aluminum imports could raise costs for charger enclosures/housing, mounting systems, and conduit and cable trays. Companies might redesign chargers to use fewer tariff-affected materials (e.g., composite enclosures instead of steel).

IDTechEx research finds that transformers dominate costs for DC chargers due to complex manufacturing and grid upgrade requirements, and wire costs remain elevated despite copper price fluctuations. The tariffs will also likely impact steel conduit prices and lead to overall longer lead times for procuring switchgears.

Domestic sourcing and contingencies keep smaller projects steady

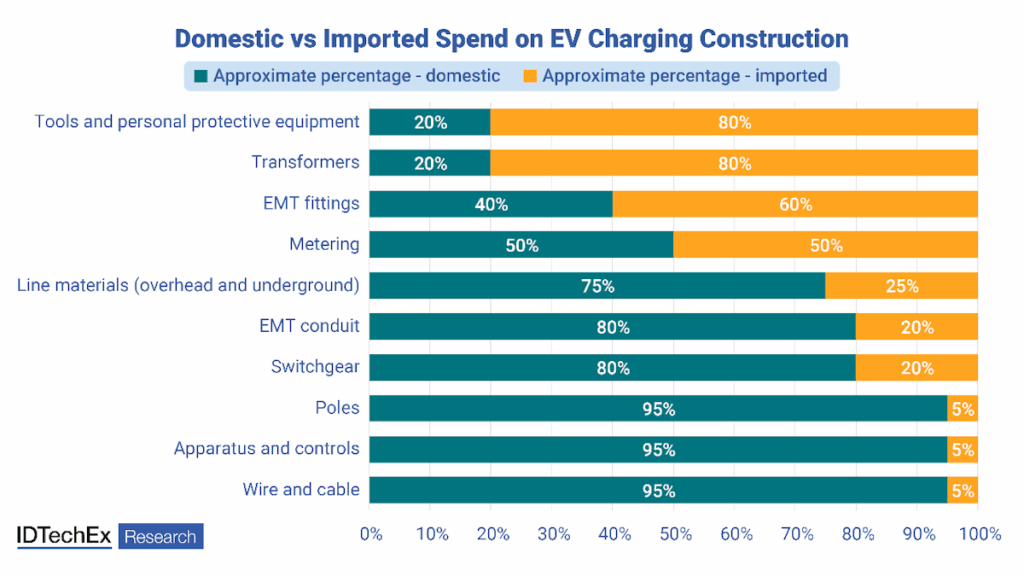

According to a recent supply chain update by Border States, approximately 80-90% of electrical construction materials, such as conduits and panels, are manufactured domestically in the US. The remaining 10-20% are imported, primarily from Mexico, where products that meet USMCA (United States-Mexico-Canada Agreement) origin requirements are not subject to tariffs. Additionally, materials such as copper, steel, and aluminum are not subject to new additional reciprocal tariffs (but are subject to 25% Section 232 tariffs).

Given that labor and soft costs remain unaffected, the overall potential increase in total project costs is estimated at 10-13% for projects that do not require any grid upgrades. This increase is typically absorbed within standard contingency budgets, with the financial impact distributed across project stakeholders.

EV charging manufacturers have also been gearing up for US-based production since the start of the Biden administration, aligning with strict Buy America requirements for federal procurement. While prices are expected to rise, most major players have spent the past 3-4 years building local factories and assembly lines to prepare.

Large DC charging projects face a bigger threat beyond tariffs. The real problem remains with imported transformers, which have long lead times and a lack of domestic production capacity. Around 80% of transformers in the US are imported. In 2024, the US imported US$29.2B of electrical transformers, being the 17th most imported product in the country. In 2024, the main origins of the US’ electrical transformers imports were: Mexico (US$6.16B), China (US$3.86B), Thailand (US$2.44B), South Korea (US$1.8B), and Vietnam (US$1.61B). Requests for more US-made transformers to address a critical nationwide shortage have echoed throughout Washington for years and continue to be a bottleneck in deploying large public EV charging sites.

Overall, IDTechEx finds that the tariffs risk slowing EV charging infrastructure growth by raising costs and creating supply chain friction. However, they could also accelerate domestic production and innovation in materials and grid technology.

You can read more about the impact of the tariffs on the EV landscape here.

For more information on the EV charging market, IDTechEx offers independent market reports, including charging infrastructure, off-grid charging, and wireless charging. View the portfolio of related research at www.IDTechEx.com/EVChargingResearch.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.