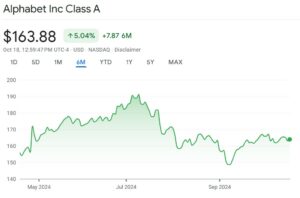

Investors looking for a strong tech stock to add to their portfolio should look no further than Alphabet Inc.(NASDAQ: GOOGL), Google’s parent company. With strong fundamentals, favorable market conditions, positive analyst predictions, and potential catalysts for growth, Alphabet’s stock could rally by as much as 30% by Christmas.

Strong fundamentals support Alphabet’s potential rally

Alphabet boasts solid fundamentals that provide a strong foundation for potential stock price appreciation. The company’s revenue growth has been consistently impressive, driven by its dominant position in the online advertising market through Google. With ample cash reserves and a low debt-to-equity ratio, Alphabet’s strong balance sheet provides stability and flexibility for future investments and acquisitions. Additionally, Alphabet’s diverse business segments, including cloud computing and autonomous vehicles, offer long-term growth prospects that could further boost investor confidence and drive the stock price higher.

Alphabet Could Rally: Market conditions favor Alphabet’s stock performance

Market conditions are conducive to Alphabet’s stock performance, with a favorable macroeconomic environment and a recovering global economy. The tech sector has been a standout performer recently, benefiting from the accelerated shift towards digitalization and remote work. As a leading player in the tech industry, Alphabet is well-positioned to capitalize on these trends and deliver strong financial results that could attract more investors and drive up its stock price.

The company’s innovative AI and cloud services efforts, including the recent AI upgrades to Google Shopping, have analysts predicting positive results, especially as the Q3 earnings report approaches next week. Expectations should be high, investors should be excited about its upside potential, and Alphabet could rally.

Analysts predict a significant increase for Alphabet

Analysts are bullish on Alphabet’s stock, with many predicting a significant increase in the company’s share price shortly. Analyst consensus estimates point to double-digit revenue growth and improved profitability for Alphabet, driven by the continued strength of its core advertising business and the growth of its other revenue streams. With an average price target well above the current stock price, analysts see substantial upside potential for Alphabet’s stock, making it an attractive investment opportunity for investors seeking capital appreciation.

With the S&P 500 hitting fresh all-time highs and the Federal Reserve likely to cut interest rates soon, tech stocks like Alphabet are poised to benefit.

Catalysts for growth could propel Alphabet’s stock price

Several catalysts for growth could propel Alphabet’s stock price higher in the coming months. The rollout of 5G technology, the expansion of cloud computing services, and the increasing adoption of artificial intelligence are all potential drivers of revenue growth and profitability for Alphabet.

The refreshed price target is $220, close to the street-high target of $240, and the outlook is undeniably bullish. Furthermore, if this happens, Alphabet shares will have soared to all-new highs. Alphabet’s strong fundamentals, favorable market conditions, positive analyst predictions, and potential catalysts for growth make it a compelling investment opportunity. Alphabet could rally with an upside potential of up to 30% before Christmas.